Python vs the Pandemic – see more in this series >

Distributing Financial Relief

Imagine you’re a major accounting and consultancy firm. Your clients are hurting, and the US government has just invented a completely new type of loan to provide relief. But nobody knows how to apply for – or issue – these loans, so you need to build the process from scratch.

Can you really build an application processing system, from a blank sheet of paper, in less than a week?

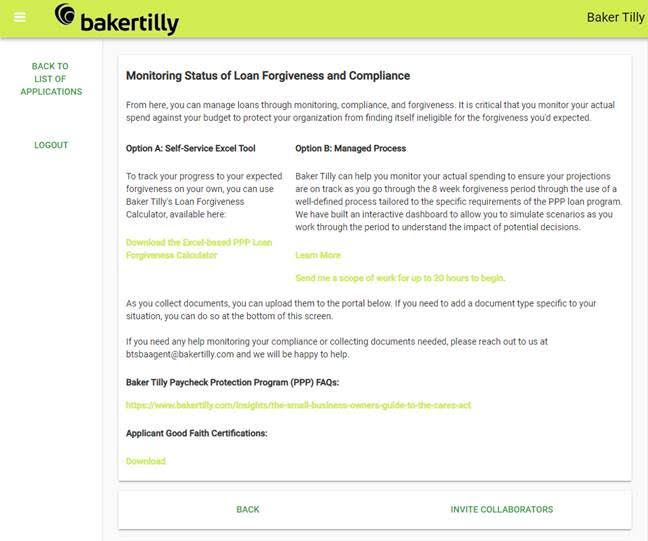

Baker Tilly’s portal for accessing financial relief under the CARES Act

What’s a forgivable loan, anyway?

The CARES Act, the USA’s Coronavirus relief scheme, wanted to keep businesses viable and avoid catastrophic layoffs due to the pandemic.

So Congress invented a new form of forgivable loan: the “Paycheck Protection Program”. The idea was for existing lenders (such as banks) to loan money to struggling businesses. The government guaranteed the loan, even if the borrower went under. This sweetened the deal for the lender: if they didn’t have to worry about getting paid back, they’d be able to issue more loans – and faster.

What’s more, the government promised to pay off some or all of the loan themselves – even if the borrower wasn’t in any financial difficulty – as long as the borrower kept their staff employed. This sweetened the deal for the borrower: The government was literally giving them money to keep people employed.

This was a loan like no other, but nobody yet had a process for issuing them. Banks weren’t used to issuing those loans, borrowers weren’t used to applying for them - and the applications needed to start fast. Baker Tilly’s clients were struggling to keep their businesses afloat.

The Paycheck Protection Program is key to the administration’s efforts to blunt the economic fallout from the coronavirus. But the program got off to a slow start after the Small Business Administration and Treasury Department released the final rules just hours before it was set to launch Friday.

Several of the country’s largest banks didn’t immediately participate in the program, saying they needed more time to understand how it would operate. Others limited applicants to companies with which they already had a relationship, leaving thousands of small businesses scrambling to find a lender.

Aaron Gregg & Renae Merle

The Washington Post

So Baker Tilly picked up Anvil and built workflow tools to streamline the whole application process.

A process like no other – in four days

The bill was signed into law on Friday the 27th of March.

By the next Thursday morning, Baker Tilly’s PPP application portal was ready for their clients – that’s less than four business days later!

Todd Bernhardt

Partner, Baker Tilly

Find out more

Baker Tilly have prepared a bunch of helpful resources about the CARES Act and PPP:

-

A recorded webinar for small businesses and non-profits.

-

You can see the new PPP portal in action in their PPP Solutions Tutorial

Python vs the Pandemic

2020 has been a difficult year for people all around the world.

We’ve seen an incredible response from the Anvil community, with a number of our users building tools and applications to help deal with the effects of the COVID-19 pandemic. We’ll take a look at some of the tools being built with Anvil to help people impacted by the virus.

Want more? Check out Meredydd’s interview with the MDU Public Health Lab!

Build your own app with Anvil

If you’re new here, welcome! Anvil is a platform for building full-stack web apps with nothing but Python. No need to wrestle with JS, HTML, CSS, Python, SQL and all their frameworks – just build it all in Python.

Want to build an app of your own? Get started with one of our tutorials:

Data Dashboard

Build Database-Backed Apps

Build a Simple Feedback Form

Build a data-entry app, and learn the techniques fundamental to building any Anvil app. In this tutorial, you will:

- Write server-side Python

- Build your User Interface

- Write client-side Python

- Store data in a database

- Deploy your app

By

By